tax benefit rules for trusts

Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable.

Investment Out Of Borrowed Funds Do Not Affect Capital Gain Exemption U S 54 Or 54f Investing Capital Gain Capital Gains Tax

While laws vary from one country to the other it.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

. Basically the tax benefit rule is that the recovery of a prior deduction does not constitute taxable income if the deduc-tion did not result in a reduction of taxable income ie a tax benefit in. Charitable Trusts and NGOs Tax Benefits List. A Health and Education Exclusion Trust HEET can be used to pay for the educational or medical expenses of grandchildren with two primary tax benefits.

The tax benefits of trusts vary from one country to another but often include some sort of tax exemptions that make it possible for the beneficiary to avoid. 111 partially codifies the tax benefit rule which generally requires a taxpayer to include. Excepted Group Life Trusts to remain subject to inheritance tax rules.

Chat With A Trust Will Specialist. Understand the different types of trusts and what that means for your investments. New Tax Rules for US.

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in. Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties.

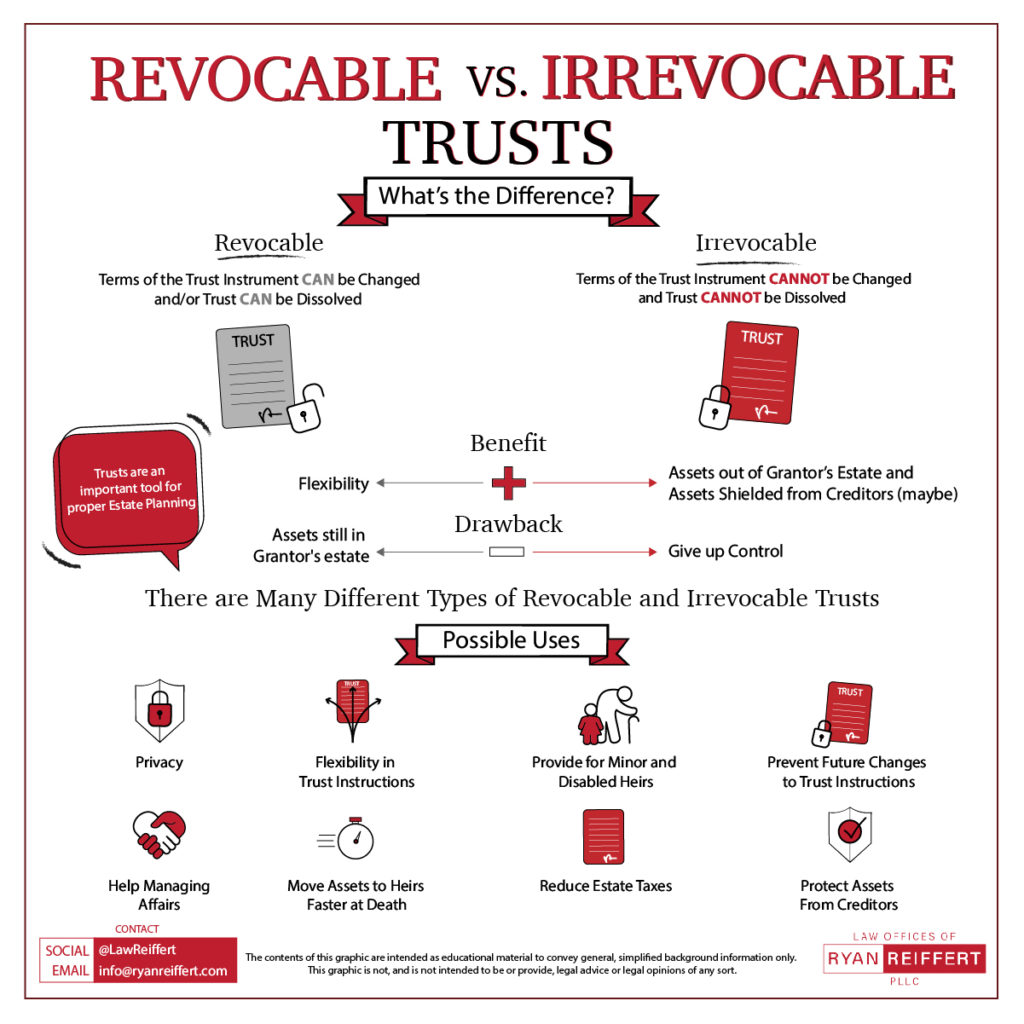

As long as a trust is not settlor-interested broadly where the settlor or their minor children can benefit. Despite a recent HM Treasury review trusts established to hold excepted group life or relevant life. Assets in a revocable trust are included in the grantors gross estate for federal estate tax purposes.

All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about. The following Sections of the Income Tax Act allow tax exemptions for charitable trusts and NGOs in India. Taxes on non-grantor trusts If grantor trust rules dont apply then the key question becomes who is entitled to trust income.

Charitable Trusts and NGOs Tax Benefits List. This means that you. Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules.

In general the trust must pay income tax. Trusts can be hugely beneficial for income tax purposes in the right circumstances. Chat With A Trust Will Specialist.

Ad Fisher Investments has 40 years of helping thousands of investors and their families. Many estate plans that utilize Jointy. Ad Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively.

In many cases one of the main tax benefits of trusts is that the beneficiary is not subject to a large amount of inheritance taxes. Ad Built By Attorneys Customized By You. A tax benefit in the prior taxable year from that itemized deduction.

Find out more by reading the information on. A charitable trust described in Internal Revenue Code section 4947 a 1 is a trust that is not tax exempt all of the unexpired interests of which are devoted. Revocable trusts also called living trusts are one of the more.

How To Avoid Estate Taxes With A Trust

Pin By The Taxtalk On Income Tax Prove It Sourcing Credits

Tax Exemption For Charitable Trust Prosperity Road Signs Tax Free Weekend

Year End Planning Tips By The Numbers The Closing Quarter Of The Year Is A Great Time To Review You Relationship Management Investment Portfolio How To Apply

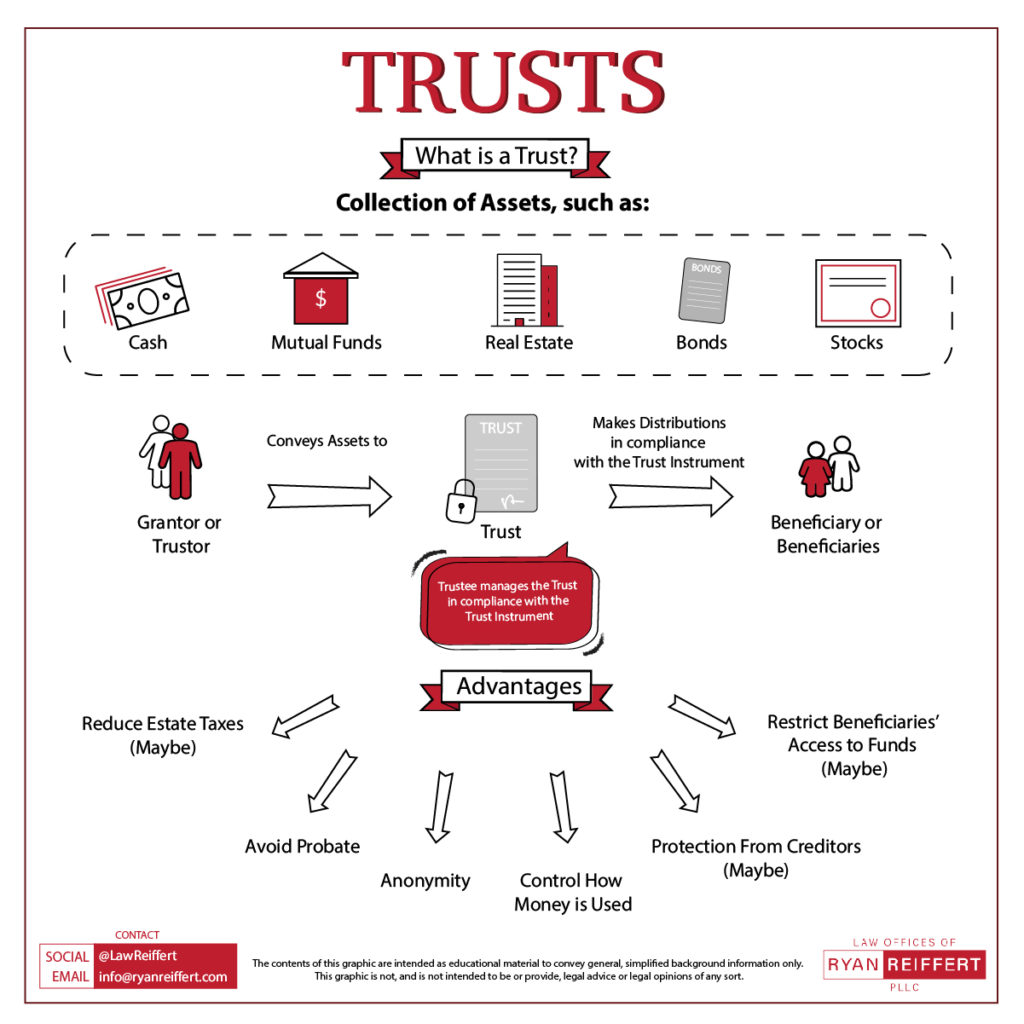

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

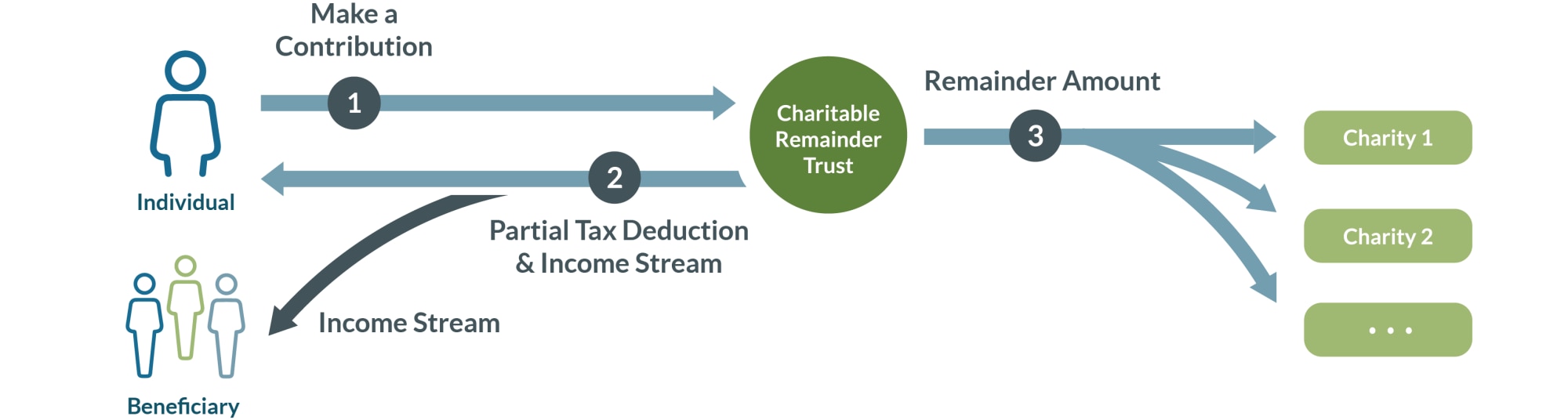

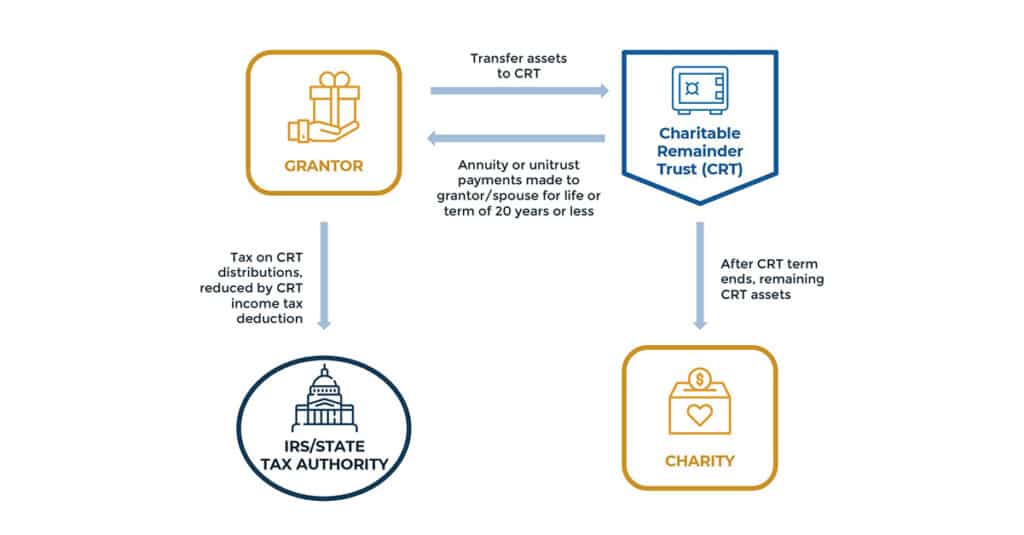

Charitable Remainder Trusts Fidelity Charitable

The Difference Between A Trust And A Foundation Infographic Http Www Assetprotectionpackage Com The Difference Between A Tru Infographic Foundation Custom

All You Need To Know About Institutional Donors In Your Fundraising Strategy For Your Non Profit Propos Fundraising Strategies Grant Writing Fundraising Sites

Where To Store Important Documents Certificate Of Deposit Adoption Papers Important Documents

Exploring The Estate Tax Part 2 Journal Of Accountancy

Charitable Remainder Trusts Crts Wealthspire

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

Cbdt Condones Of Delay In The Filing Of Form 10bb By Trusts And Institutions Institution Taxact Tax Rules

Generation Skipping Trust Gst What It Is And How It Works

Distributable Net Income Tax Rules For Bypass Trusts

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide